As economy tanks, Pak govt covets citizen’s gold to boost forex reserves Will this keep the country afloat?

The United States is the single largest holder of gold reserves with 8,100 tons which constitutes 74% of its foreign reserves. In such instances, the nation’s central financial institution used its reserves to meet that obligation, backing some or the entire forex in issue with the metallic it held. India holds 50 tons more gold than the European Central Bank, with 557.eight tons. When Ramadan and Eid-ul-Fitr were approaching, a representative of the Bangladesh Bank, Mezbaul Haque, stated that the remittance flow will also grow during the coming few months. Haque predicted that the foreign exchange reserves would reach a comfortable level, but he also noted that things would not change quickly.

However, this number has come down from the previous $46 billion. However, in 2021, China opened the doors to national and international trade of gold in the country to support its economy. About 150 metric tons of gold will be shipped to China in April or May.

However, the project was stopped after the provincial government did not agree to renew Tethyan Copper’s lease in 2011. World Bank’s arbitration tribunal ICSID took up the case and imposed a penalty on Pakistan for unlawful denial of mining. pakistan gold reserves Using the production or demand or inventory formula in the form of demand and supply. Activities of the Central Bank such as money printing, gold purchases and sales. US and Global inflation which is driven by the rising money supply.

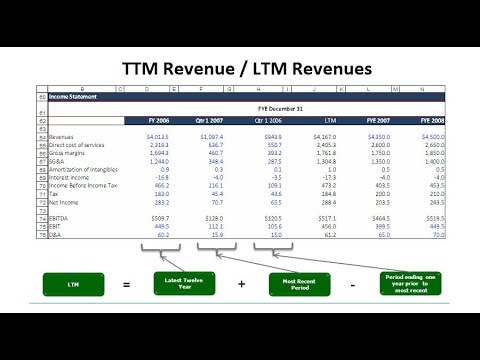

View Pakistan’s Foreign Exchange Reserves from Jan 1959 to Feb 2020 in the chart:

Each economy must manage its foreign exchange reserves for it to run smoothly. They consist of all foreign holdings of a country’s central bank. They are held in the form of gold or cash and are used to safeguard the stability of the nation’s financial markets and the balance of payments. In October 2021, India’s foreign exchange reserves hit an all-time high of $645 billion, but the trend has since reversed and declined as the rupee’s value has plummeted over the US dollar.

After 2009, China became secretive about the country’s gold activity. Since 2015, the People’s Bank of China has started to share its monthly gold purchasing projects. Although China is in the top 10 most extensive gold reserves list, only 3.3% of its foreign reserves of it account for gold.

Is Pakistan producing gold?

Pakistan has significant deposits of precious metal gold worth billions of dollars, besides other high-value mineral resources.

When the inflation rates soar high, the value of the currency goes down. Also, most other investment avenues flop to deliver inflation-winning returns. Even if high rates of inflation last for a longer period, gold acts as ideal privet since it is not influenced by fluctuations in the value of the currency. If interest rates fall, individuals don’t get attractive returns on deposits. Hence, they break their deposits and buy gold instead to increase demand and it automatically increases price. And people sell their gold and invest in their deposits when interest rate goes high, it leads to a drop in demand and so the price.

Latest Factors Affecting Gold Prices, Gold Rate Forecast or Prediction

The authorities has solely lately taken steps to encourage commercial gold mining on a large scale as it’s thought that there’s a substantial amount of wealth hidden beneath its soil. Russia holds over a third more gold than Switzerland, with 1,778.9 tons of the stuff. The nation cannot get enough of this treasured metallic and has been busy increasing its reserves over current years. Foreign trade reserves of India act as a cushion towards rupee volatility as soon as international interest rates begin rising. The International Monetary Fund , situated in Washington, DC, is designed to work in the direction of sustaining and securing financial stability as well as help in worldwide commerce. The objective that they aspire to attain is to encourage a sustainable financial system and reduce conditions of poverty on the earth.

Which country has the largest gold reserves?

The United States has the largest gold reserve, with more than 8,000 metric tons of gold. This was more than twice the gold reserves of Germany and more than three times the gold reserves of Italy and France.

The market participant’s trade by phone or fax instead of a physical trading floor. What acts as the spot price is the financial institutions that act as market makers and offer a bid or ask for a bid. The reserve losses are primarily due to the RBI selling dollars to stem the rupee volatility in the spot and forwards market to prevent runaway moves in the exchange rate. The two international firms were part of the consortium Tethyan Copper company and had found vast gold and copper deposits at Reko Diq. But the hugely lucrative open-pit mine project came to a standstill in 2011 after the local government refused to renew Tethyan Copper’s lease, and in 2013 the Supreme Court declared it invalid.

OTC markets

The oil rich nation of Saudi Arabia has the highest gold reserves within the Middle East, with 322.9 tons of the dear metallic. As a part of plans to diversify its financial base and place much less of a reliance on oil, Saudi Arabia is also dedicated to boosting its gold mining business. Archaeological research present that gold started being mined in the country as much as 5,000 years in the past. The world’s largest precious-metal market had run out of gold, drained by a five-month run on America’s stash by European central banks. The crisis marked the beginning of the end for the Bretton Woods standard that had kept the dollar pegged to gold, and currencies elsewhere to the dollar, since 1944.

Is quite excited in particular about touring Durham Castle and Cathedral. We can also merely say ‘reserves.’ Governments attempt to construct up reserves of exhausting currencies, such because the greenback, euro, Swiss franc, or pound. Plans are currently being put in place to maneuver its gold bullion from its current vaults in central Amsterdam to a new purpose-constructed facility near Zeist. Many nations choose to store their gold within the closely fortified Bank of England vault in London, the second largest in the world after the vault on the New York Federal Reserve. Research also stated that the Bangladesh reserves will surpass $50 billion for the first time by the conclusion of the fiscal year 2026–2027.

Russia sold most of its American treasuries to buy this enormous amount of gold. In 2020, the top 10 countries traded more than one metric ton of gold, emphasizing just how important this metal is in the world economy. “Prior to 1933 and for well over 100 years, the dollar was backed by gold, and $20 bought you an ounce of gold. So compelling has been the rise of the Chinese economy and the concomitant rise of the Yuan that the IMF has had no option but to accept the Yuan into the IMF’s foreign exchange basket. I had been predicting this for years in various articles; so had many others all over the world.

Fitch, Moody, and S&P have all downgraded Pakistan’s rating 7 times in the last 10 months – unprecedented for the country. The forex reserves stand at a feeble $3 billion which means the country is severely close to defaulting. The IMF is forcing the government to adopt tougher taxation policies for a bailout, which will irk the populace further. The situation is so dire that around 800,000 Pakistani professionals exited the country in 2022 primarily due to a lack of jobs and the stifling prices of everyday commodities. According to the WGC data from April 2021, central banks bought about 273 tons of gold in 2020.

The revival of the Reko Diq copper and gold mine project in Balochistan with billions of dollars at stake was cleared by the Supreme Court last week. In any traded commodity, demand and supply play a prominent role in defining its price. Gold is not a consumable product so all gold is still present on earth that ever mined. And so, if demand for gold goes up, the price goes up since the supply is comparatively uncommon.

New Oil And Gas Reserves Discovered In Pakistan

Experts predict this announcement will trigger one of the most profound transfers of wealth in our lifetime. So if you want to protect your savings and retirement, you better get your money out of US dollar investments and into the one asset class that rises as currencies collapse. Ever since this Great Gold Swindle these same ‘economists’ have been telling us that the world could never return to the Gold Standard. According to Goldman Sachs central-bank purchases may total about 650 tons in 2019, about the same as last year, amid elevated geopolitical tensions and less pressure on emerging-market currencies, according to a Feb 7 note. Buyers in recent months have included Turkey and Kazakhstan, IMF figures show, noted the Bloomberg report. China’s total reserves stands at a whopping 1,864.30 tonnes, as per the WGC report.

- So if you want to protect your savings and retirement, you better get your money out of US dollar investments and into the one asset class that rises as currencies collapse.

- Gold provides a way to circumvent Western sanctions on Russia, much of whose reserves have been frozen since March and whose banks have mostly been disconnected from the dollar-based international-payments system.

- Central banking authorities that have entry to such can use these measures in order to meet goals set out by national monetary insurance policies, and in setting steadiness aims for cost accounts.

- Buyers in recent months have included Turkey and Kazakhstan, IMF figures show, noted the Bloomberg report.

- “The Government’s official holdings of international reserves comprise gold and foreign forex assets, and Special Drawing Rights .

As markets turns into more and more globalized, foreign currency change reserves turn out to be more crucial as well. Total reserves are additionally inclusive of any holdings of foreign exchange that may be under the management of these with authority over monetary undertakings inside a given nation. The reserves of foreign exchanges and gold can be used to check the dollar worth for stocks and other monetary belongings. Russian gold is banned on the London market, but no one can get at its gold reserves, which are mostly sourced from its own mines. And Russia’s central bank no longer reports how much gold it holds, making swaps impossible to track.

Some Dutch gold can be said to be held at the Bank of England, the Bank of Canada and the Federal Reserve Bank in America. The Netherlands takes the number 10 spot on the World Official Gold Holding Chart with 612.5 tons of gold in its stocks. The country’s reserves decreased by $8.3 billion to $566.95 billion as of February 10 the lowest level since April 2022, according to the Reserve Bank of India’s statement on . After a stunning investigation of corruption and fraud by New York-based financial research company Hindenburg Research, which placed pressure on the rupee, Adani Group’s share price fell in late January.

Switzerland with a total reserve of 1,040 tonnes, Japan (765.20 tonnes), Netherlands (612.50 tonnes) rank ahead of India in the list. The forex reserves had been intermittently falling for months now largely because of the RBI’s intervention in the market to defend the depreciating rupee against a surging US dollar. Ans- There are lots of factors that are found to make the gold prices fluctuate like liquidity, demand and supply, inflammation, global economy and others. India accounts for less than one percent of gold production globally.

A gold reserve is a gold owned by a country to boost a country’s economy, especially during a period of hyperinflation. As the price of gold increases, so does their currency and economy. The top 10 countries that hoarded the most significant amount of this shiny metal are listed below.

The discoveries of gold and copper are expected to attract investment up to $533 million and generate around 4,000 jobs, reported Al Arabiya while helping the country to move past its economic dependence on oil. Ans- In most cases, this gold rate prediction tries to be as accurate as possible. But the actual gold prices may vary depending on various underlying factors. Central banks may increasingly recognize that the rules of the game are changing.

COMMODITY TRADING

One way this happened was via a complete revamp of India’s existing trade policy framework – the goal was to produce an export-oriented economy. India augmented trade relations with its neighbors, including China, as well as other South Asian countries. As per the news report, the new bill “fits very well with the Chinese playbook of salami slicing and gobbling up the territories” to advance its own geostrategic ambitions. Data vendors use a specific documented methodology to determine the closing price.

What is national gold reserve of Pakistan?

Pakistan currently holds $3.82 billion worth of gold.

Finance minister Nirmala Sitharaman asked state-run banks to review their business models closely to identify stress points, urging them to remain vigilant amid a deepening banking crisis in the US and Europe. Last month, the government slapped a 17 per cent sales tax on the sale of gold and jewellery. This is the current market price at which gold was bought or sold for immediate payment and delivery. At the start of the last year 2022, the overall forex reserves were at about USD 633 billion.

Are Pakistan reserves all time high?

Foreign Exchange Reserves in Pakistan averaged 16651.09 USD Million from 1998 until 2023, reaching an all time high of 27067.70 USD Million in August of 2021 and a record low of 1973.60 USD Million in December of 1999.