Mark to Market Accounting

All of these are recorded at historic cost and then impaired as circumstances indicate. Correcting for a loss of value for these assets is called impairment rather than marking to market. Mark to market is an accounting practice that involves adjusting the value of an asset to reflect its value as determined by current market conditions.

- If interest rates rise following that investment decision, the value of those bonds will decline.

- That made it seem the banks were in better financial shape than they were.

- Correcting for a loss of value for these assets is called impairment rather than marking to market.

It is because the trader is holding a long position in the same futures. Mark-to-market losses are paper losses generated through an accounting entry rather than the actual sale of a security. In personal accounting, the market value is the same as the replacement cost of an asset.

Bank accounting conservatism and bank loan pricing

We start by considering the operation of the banking and insurance industries separately. Conditions are identified where it is optimal for the insurance companies to insure firms when only a limited number of machines are damaged, and go bankrupt when a large number of machines are damaged. This partial insurance is optimal if the probability of a large amount of damage is small and the return on the long asset is high so the opportunity cost of investing in the short asset is also high.

The Basis for Conclusions section has an extensive explanation of what was intended by the original statement with regards to nonperformance risk (paragraphs C40-C49). Problems can arise when the market-based measurement does not accurately reflect the underlying asset’s true value. This can occur when a company is forced to calculate the selling price of its assets or liabilities during unfavorable or volatile times, as during a financial crisis. This is done most often in futures accounts to ensure that margin requirements are being met.

Examples of Fair Accounting Uses

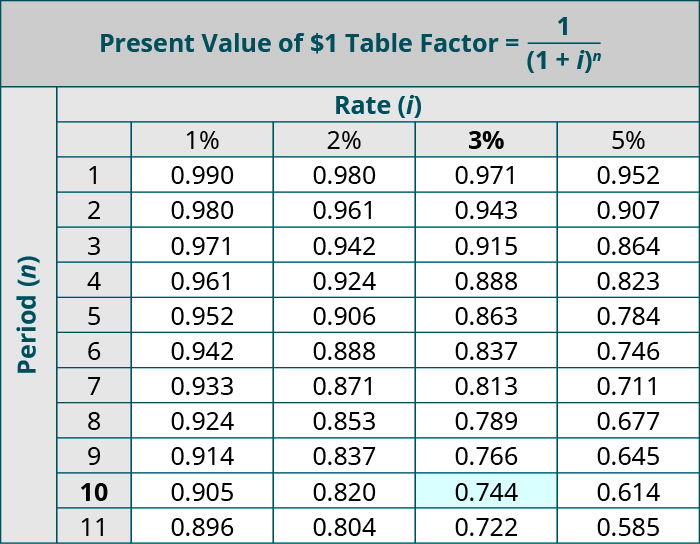

The value of shares and ETFs bought through a share dealing account can fall as well as rise, which could mean getting back less than you originally put in. Second, FAS 157 emphasizes that fair value is market-based rather than entity-specific. Thus, the optimism that often characterizes an asset acquirer must be replaced with the skepticism that typically characterizes a dispassionate, risk-averse buyer. Note that the Account Balance is marked daily using the Gain/Loss column. The Cumulative Gain/Loss column shows the net change in the account since day 1.

Although FAS 157 does not require fair value to be used on any new classes of assets, it does apply to assets and liabilities that are recorded at fair value in accordance with other applicable rules. The accounting rules for which assets and liabilities are held at fair value are complex. Mutual funds and securities companies have recorded assets and some liabilities at fair value for decades in accordance with securities regulations and other accounting guidance. For commercial banks and other types of financial services companies, some asset classes are required to be recorded at fair value, such as derivatives and marketable equity securities. For other types of assets, such as loan receivables and debt securities, it depends on whether the assets are held for trading (active buying and selling) or for investment.

Use in Personal Accounting

The insurance sector only needs to hold the short asset to pool the risk for the firms whose machines may be damaged. However, if credit risk transfer is introduced to allow the banking and insurance sectors to diversify risk, insurance companies may find it optimal to hold the long asset. This provides the potential for contagion of systemic risk from the insurance sector to the banking sector. Internal Revenue Code Section 475 contains the mark to market accounting method rule for taxation. An exchange marks traders’ accounts to their market values daily by settling the gains and losses that result due to changes in the value of the security. There are two counterparties on either side of a futures contract—a long trader and a short trader.

- They then scrambled to increase the number of loans they made to maintain the balance between assets and liabilities.

- This can occur when a company is forced to calculate the selling price of its assets or liabilities during unfavorable or volatile times, as during a financial crisis.

- However, some countries are permitted to value the short term investment on a mark to market basis, which is a fair valuation.

- To estimate the value of illiquid assets, a controller can choose from two other methods.

Valuation on the mark to market basis is to revalue the investment to the current market value and re-calculate the deposit. If the deposit is a shortfall, then the trader has to deposit the remaining amount, and if the deposit is in excess, then it will be held to the exchange only till the securities are sold. Some exchanges practice valuing on the mark to market basis twice daily so that the traders can re-calculate the deposits twice and adjust the same with the price fluctuations.

Build your skills with a risk-free demo account.

The accountant would discount the original value by the percentage risk that the borrower will default. At the end of each fiscal year, a company must report how much each asset is worth in its financial statements. It’s easy for accountants to estimate the market value if traders buy and sell that type of asset often. In the financial services industry, there is always a probability of borrowers defaulting on their loans. In the event of a default, the loans must be qualified as bad debt or non-performing assets. It means that the company must mark down the value of the assets by creating an account called “bad debt allowance” or other provisions.

Interim results for the period ended June 30, 2023 – GlobeNewswire

Interim results for the period ended June 30, 2023.

Posted: Thu, 10 Aug 2023 09:59:04 GMT [source]

Mark to market inflated the housing bubble and deflated home values during the decline. An accountant reprices the asset according to the quoted rate in the market. If the Treasury yield rate rose during the year, the accountant must mark down the value of the notes. The note that the bank holds doesn’t pay as much in interest as new notes. If the company sold the bond, it would receive less than it paid for it. The values of Treasury notes are published in the financial press every business day.

Where have you heard about mark to market accounting?

In the 1800s in the US, it was the general practice to record assets and other securities at the mark to market price, but this contributed to recession and depression, which results in the collapse of major banks and bankruptcy situations. The Securities and Exchange Commission requested the president to remove the valuation on the mark to market basis, and the president approved it in 1938. Mark to market accounting is a method of accounting in which accounts whose value may change over time, which includes certain assets or liabilities, are valued based on their current price.

Top AI Tools for Accounting 2023 – MarkTechPost

Top AI Tools for Accounting 2023.

Posted: Fri, 04 Aug 2023 07:00:00 GMT [source]

Mark to market trading was developed throughout the 20th century – however, it wasn’t until the 1980s that the practice was taken up by banks and major corporations. A futures trader would begin an account by depositing money with the exchange, called a margin. The contract is marked Mark to market accounting at its current market value at the end of every trading day. If the trader is on the positive side of a deal, the exchange pays the profit into his account. If the trader is on the negative side of the deal the exchange charges him the loss that holds his deposited margin.

It is a very useful concept for investors to understand, especially those who are involved in futures trading. Here are some of the advantages of Fair Value or mark to market accounting. Suppose two parties enter into a futures contract for 5,000 bushels of soybeans for $16 per bushel with a 6-month maturity period. These are debt or equity securities that an investor buys but intends to sell before the securities reach maturity. After this, they would need to estimate the percentage of customers they believe will use the discount and then debit the contra revenue account, sales discount, and credit the contra asset account, allowance for sales discount. The company would need to debit accounts receivable and credit sales revenue for the full amount of the sale.

Mark to market show the current market value of market price of assets and liabilities. The major goal of Mark to market is to give a reliable report on a company’s financial status based on the current price of the assets and liabilities they hold. Mark to market accounting is the system in which a company measures the assets and investments at market value rather than historical cost. The market value calculates on the basis of the value of an asset if the asset is sold at the current date or the balance sheet date. In the case of mutual fund securities or short-term securities, the securities are valued at market price.

Mark to market (MTM) is an accounting method that is based on measuring the value of assets based on their current price. It is also called a fair value accounting that measures the value of assets or liabilities whose value can change over time. Hence, ‘fair’ value approach is adopted when measuring these accounts (assets and liabilities).