What is a Cash Flow Statement and its Objectives? Buy Income Earn-Joy Your Leisure

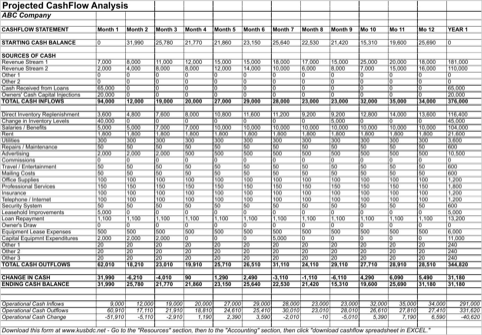

Any time you’re projecting a shortfall, the closing cash balance will alert you by turning red, which prompts you to make some changes. In the template provided, you can see that a shortfall is predicted in the second month. You can customize a row for each expense and each revenue source—be as detailed or broad as you need to be. New and growing businesses often don’t have a buffer of extra cash to get them through shortfalls, because they’re always reinvesting. Years with the most significant growth—including the first few years of a business’s lifespan—are also challenging when it comes to cash flow.

The reason for the increase in and decrease for cash can be indicated by the cash flow statement. Cash flow analysis discloses the various reasons for low cash balance in spite of heavy operation profits or for heavy cash balance inspite of low profits. Depending on the complexity of your technology stack as well as the size of your organization it is worth looking into the different cash flow forecasting tools that are available on the market.

Cash Flow Statements

The cash flow statement is a financial statement that summarizes the amount of cash and cash equivalents flowing in or out of the company during a specified period. It provides information regarding the sources and uses of cash and cash equivalents. For granular short-term forecasts on a daily basis, as in the example below, we consider all outflows and inflows, the net cash flow, and the closing balance for each day. The cash inflow of cash outflow for a particular period is determined from the inflow and outflow of fixed assets of a business concern. The cash flow statement is not less important to those who use the published financial statements of a company. Potential creditors always remain eager to know about the liquidity position of concern before making any transaction.

Warner Bros. Discovery Q2 Financials: Revenues/Streaming … – Cartoon Brew

Warner Bros. Discovery Q2 Financials: Revenues/Streaming ….

Posted: Thu, 03 Aug 2023 14:56:24 GMT [source]

Cash Flow Statement, no doubt, helps the management to make a cash forecast for the near future. A projected Cash Flow Statement helps the management about the cash position which is the basis for all operations and, thus, the management sees light relating to cash position, viz. How much cash is needed for a specific purpose, sources of internal and external issues etc. IFRS 7 specifies the methods to prepare the cash flow statement and the disclosure requirements. Maximum companies use the indirect method to prepare the cash flow statement. The cash flow statement is just one of several financial statements that provide information about a business.

Cash flow forecasting tools and automation

An organisation has to deposit the amount of the dividend in a separate Dividend Bank A/c within 5 days of its declaration. The management can thus, take the help of the cash flow statement in ascertaining the position of the cash generated from its operating activities which can ultimately be used for paying dividends. A cash flow statement reveals the speed at which the current liabilities are being paid and cash is being generated from inventory, trade receivables, and other current assets by the company. By doing so, the management of the company can easily assess its true position of cash in future. It is created by either doing an analysis of cash transactions or by shifting financial transactions that were created using the accrual basis to the cash basis.

The Kroger Co. (NYSE:KR) Looks Interesting, And It’s About To Pay A Dividend – Yahoo Finance

The Kroger Co. (NYSE:KR) Looks Interesting, And It’s About To Pay A Dividend.

Posted: Wed, 09 Aug 2023 10:01:20 GMT [source]

A cash flow statement records these inflows and outflows so you can see it all at a glance and dive deeper where needed. It discloses the volume as well as the speed at which the cash flows in the different segments of the business. This helps the management in knowing the amount of capital tied up in a particular segment of the business. The technique of cash flow analysis, when used in conjunction with ratio analysis, serves as a barometer in measuring the profitability and financial position of the business. Cash flow forecasting is important because it enables businesses to make informed strategic decisions by having an accurate picture of what their cash position looks like in the future.

Management Accounting in Competitive World

In many cases, your sales from this week one year ago will be more accurate than your sales last week, because historical data takes annual cycles and seasonality into account. If you believe your sales will grow over last year’s, you can increase the amount, but it’s important to be conservative to avoid ending up in a bad situation. Moreover, the cash flow statement plays an important role in planning and controlling the future courses of action of a business concern. It is a significant pointer about the movement of cash, i.e. whether there is any increase in cash or decrease in cash and the reasons thereof which helps the management. Moreover, it explains the reasons for a small cash balance even though there is sufficient profit or vice versa.

This can improve your cash position month by month and help you prepare for any unforeseen impacts on your customers or suppliers. Getting good at cash flow management is one of the best things you can do for your business. Not only that, it’s a skill you can carry over into other ventures, as well as your personal finances. The indirect method uses net income as a starting point, makes adjustments for all transactions for non-cash items, then adjusts for all cash-based transactions. An increase in an asset account is subtracted from net income, and an increase in a liability account is added back to net income.

- A good rule of thumb for small business cash flow management is the farther you look into the future, the less accurate your predictions will be.

- Thus, a cash flow statement keeps track of cash and cash equivalents of a company generated through operating activities, investing activities, and financial activities.

- Cash flow analysis discloses the various reasons for low cash balance in spite of heavy operation profits or for heavy cash balance inspite of low profits.

- Predicting future cash flows also helps to identify scenarios where your business will run out of money, giving you the time to proactively prevent that from happening.

The different sources that you should pull your data from include ERP systems, banks, treasury management systems, subsidiaries, spreadsheets, payment hubs, accounting software, AR and AP solutions, etc. Basically, every source that includes relevant data is required to cash in and outflows. Also consider whether you want to do your cash forecasting on a group, subsidiary, geographical, or any other level. Nowadays, in preparing financial statements, the cash flow statement is considered as an important element.

Objectives of a Cash Flow Statement

There are many different cash flow forecasting templates out there that you can use. Here are some examples of cash flow forecasting templates that we like to use. The net result of cash inflow and cash outflow for a particular period of a business can be known from the above-mentioned three steps.

Once the cash book has been balanced, it is usual to check its details with the records of the firm’s bank transactions as recorded by the bank. Long story short, objectives guide us to plan our finances well, both short-term and long-term. Even if your company is not required to file a statement, still create one. The main purpose is to record your cash income and outgoings over a given period.

Investortonight a wide range of articles, tutorials, and videos on these topics, including entrepreneurship, personal finance, leadership, strategy, and investing. Funds flow statement tallies the funds generated from various sources with various uses to which they are put. Compute Cash Flow from Operating Activities for the year ended March 31, 2021, by indirect method.

When a firm is confronted with shortage of cash, it needs to involve in emergency borrowings at a higher rate of interest and may be required to pay penalty for not meeting its obligations on time. For determining an appropriate level of cash, consideration of short costs is also important. The term short costs may be defined as costs, expenses, or loss incurred as a result of deficiency of cash at a particular point of time.

- With the help of this statement, a business concern can find out sources of cash needed and the amount of cash to be spent on different heads.

- From spreadsheets to dedicated financial management platforms, there are many options for cash flow management tools to help you get a better handle on your business.

- A cash flow statement is a type of financial report that displays a company’s inflows and outflows of cash and cash equivalents.

- Cash flow and cash flow analysis are important for virtually every business.

- The math behind a free cash flow analysis can be complex, particularly for large companies or those with complex finances.

Cash flow and profitability can differ for various reasons, such as timing, accounting methods, depreciation, inventory, and debt. A cash flow analysis determines a company’s working capital — the amount of money available to run business operations and complete transactions. That is calculated as current assets (cash or near-cash assets, like notes receivable) minus current liabilities (liabilities due during the upcoming accounting period). In addition to looking at the standard cash flow statement and details, it’s often also useful to calculate different versions of cash flow to give you additional insights.

Business

Analysis includes looking for trends, areas of strong performance, cash flow problems, and opportunities for improvement. There are two common methods used to calculate and prepare the operating activities section of cash flow statements. Small business finance is always tricky, especially during challenging times. You don’t want to get into much debt, but sometimes you need to invest in equipment or inventory that will pay off in the long run. When you lease, you can make small payments over time and keep cash flow for your day-to-day operations.

A cash flow statement helps in determining the reason behind the same by throwing light on different uses of cash generated by the firm. All the activities are classified into operating activities, investing activities and financial activities which help a firm to analyse and interpret its various inflows and outflows of cash. Net income adjusted for non-cash items such as depreciation expenses and cash provided for cash flow objectives operating assets and liabilities. Using a free public template from the Small Business Administration (SBA), let’s say Wild Bill’s Dog Trainers and Walkers had a net income of $100,000 to start and generated additional cash inflows of $220,000. Predicting future cash flows also helps to identify scenarios where your business will run out of money, giving you the time to proactively prevent that from happening.

The second one is to facilitate your work towards your cash flow objectives. Is the process of a business earning cash income and using it to pay cash expenses. Although the term ‘cash’ isn’t taken literally anymore, it does still refer specifically to money as opposed to other assets. 3) Facilitating the policy formulation by the management in respect of certain financial matters such as Dividend Policy. 1) Showing the Inflows and Outflows of cash into/out of the business during a specific period.

It helps the financial manager to make a cash flow projection for immediate future taking the data, relating to cash from the past records. As such, it becomes easy for him to know the cash position which may either result in a surplus or a deficit one. However, Cash Flow Statement is an important financial tool for the management to make an estimate relating to cash for the near future. No doubt, a cash flow statement helps the management to prepare its cash planning for the future and thereby avoid any unnecessary trouble.

Suppliers are much more likely to be flexible if you can tell them exactly how you’ll pay and when—rather than cutting communication like most businesses do during tough periods. These people want your business and will be more willing to work with you through the ups and downs if they can trust you. Similarly, just because you have $20,000 in the bank doesn’t mean you can spend it. When you look at your cash flow over weeks and months, you’ll know how much to keep on hand and how much you can stash away or spend on growth.